Best Trading Systems Using EMV to Buy in November 2025

How to Day Trade for a Living: A Beginner’s Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology (Stock Market Trading and Investing)

- ACHIEVE FREEDOM: WORK AND LIVE ANYWHERE, ON YOUR OWN TERMS!

- BE YOUR OWN BOSS: SUCCESS IN DAY TRADING MEANS ANSWERING ONLY TO YOU.

- EQUIP YOURSELF: UNLOCK SUCCESS WITH THE RIGHT TOOLS AND DEDICATION!

Trading in the Zone: Master the Market with Confidence, Discipline and a Winning Attitude

- PERFECT CHOICE FOR AVID READERS SEEKING GREAT CONTENT.

- ENGAGING STORIES THAT CAPTIVATE AND INSPIRE BOOK LOVERS.

- IDEAL GIFT FOR ANYONE PASSIONATE ABOUT LITERATURE AND BOOKS.

The Psychology of Money: Timeless lessons on wealth, greed, and happiness

- PERFECT GIFT FOR BOOK LOVERS TO SPARK JOY!

- COMPACT DESIGN, GREAT FOR READING ON THE GO.

- IDEAL FOR TRAVELERS SEEKING LITERARY ADVENTURES!

Trading: Technical Analysis Masterclass: Master the financial markets

- MASTER TECHNICAL ANALYSIS TO BOOST YOUR TRADING SKILLS!

- LEARN STRATEGIES FOR NAVIGATING FINANCIAL MARKETS EFFECTIVELY.

- HIGH-QUALITY MATERIALS ENSURE DURABILITY AND A GREAT READING EXPERIENCE.

Best Loser Wins: Why Normal Thinking Never Wins the Trading Game – written by a high-stake day trader

The Trader's Handbook: Winning habits and routines of successful traders

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.blogweb.me/1/51_Jozc_NDI_6_L_SL_160_8400d673c3.jpg)

The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

How to Day Trade: The Plain Truth

A Beginner's Guide to the Stock Market: Everything You Need to Start Making Money Today

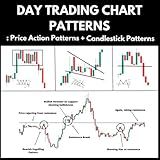

Day Trading Chart Patterns : Price Action Patterns + Candlestick Patterns

The Ease of Movement (EMV) is a technical indicator that was developed by Richard Arms to help traders identify potential trading opportunities within the financial markets. It combines both price and volume to assess the ease at which a particular security is being traded.

When using EMV for day trading, there are a few key concepts to keep in mind. Firstly, EMV calculates the relationship between price change and volume, providing a measure of the market's internal strength. It helps traders understand whether the underlying security is experiencing heavy buying or selling pressure.

To utilize EMV effectively for day trading, you can follow these steps:

- Calculate the EMV: Start by determining the EMV value for a specific period. The formula is: EMV = [(Current High + Current Low) / 2 - (Previous High + Previous Low) / 2] / Volume

- Analyze the indicator: Once you have calculated the EMV, you should plot it on a chart alongside the price of the security. You can use a line chart or overlay the EMV line on top of the price candles. This will help you visually interpret the indicator's values.

- Observe the EMV trend: Look for trends in the EMV line. If the EMV line is moving above the zero line, it indicates positive buying pressure, meaning more ease in upward price movements. Conversely, if the EMV line is below the zero line, it indicates negative selling pressure, suggesting the potential for downward price movements.

- Confirm with price action: It's always essential to consider the EMV indicator in conjunction with other technical analysis tools or price action patterns. Confirm bullish EMV readings with upward price movements, and bearish EMV readings with downward price movements. This will increase the reliability of your trades.

- Identify entry and exit points: Once you have analyzed the EMV and confirmed it with price action, you can use it to identify potential entry and exit points for your trades. Hold long positions when the EMV is positive and short positions when the EMV is negative. Additionally, you can look for divergences between the EMV and price to spot potential reversals or trend continuations.

- Set risk management parameters: As with any trading strategy, it is crucial to implement proper risk management techniques to protect your capital. Set stop-loss orders to limit potential losses and consider setting profit targets to secure your gains.

Remember, while EMV can be a helpful tool for day trading, it is essential to combine it with other indicators and analysis techniques to increase the accuracy of your trades.

What are the typical ranges or values to look for when using the Ease of Movement (EMV) indicator?

The Ease of Movement (EMV) indicator is used to measure the ease with which prices move in a given period. It helps traders and analysts to identify potential buy or sell signals based on the relationship between volume and price movement. The EMV values typically range from positive to negative, with values closer to zero implying less ease of movement.

The EMV indicator doesn't have specific ranges or threshold values that indicate a buy or sell signal. Instead, traders often look for the following general tendencies:

- Positive EMV values: When the EMV indicator produces positive values, it suggests that prices are moving upward with ease. Traders may interpret this as a bullish signal, indicating potential buying opportunities.

- Negative EMV values: Conversely, negative EMV values indicate that prices are moving downward with ease. Traders may interpret this as a bearish signal, suggesting potential selling opportunities.

- Crosses of zero line: Crossovers of the EMV line through the zero line can also be significant. When the EMV crosses above zero, it suggests a shift in sentiment towards buying, while a cross below zero indicates a shift towards selling pressure.

It's important to note that traders often complement the EMV indicator with other technical analysis tools or indicators to confirm trends and make trading decisions.

What are some common strategies for trading with the Ease of Movement (EMV) indicator?

The Ease of Movement (EMV) indicator is primarily used to identify potential trend reversals and confirm the strength of price movements. Here are some common strategies for trading with the EMV indicator:

- Divergence: Look for divergences between the EMV line and price movements. If the price is making higher highs while the EMV line is making lower highs, it could signal weakness in the price trend and a possible upcoming reversal.

- Breakout Confirmation: Use the EMV indicator to confirm breakouts. When the EMV line rises above zero, it indicates a positive and strengthening trend. Conversely, if the EMV line falls below zero, it indicates a negative and weakening trend. Use these confirming signals to enter trades when there is a breakout in the corresponding direction.

- Support and Resistance: Pay attention to how the EMV line interacts with support and resistance levels. If the EMV line bounces off a support level and starts to rise, it might provide a bullish signal to enter a long position. If it bounces off a resistance level and starts to decline, it might provide a bearish signal to enter a short position.

- Trendline Analysis: Draw trendlines on the EMV indicator to identify key support and resistance levels. When the EMV line breaks above a downtrend line, it suggests a potential upward reversal, indicating a bullish signal. When the EMV line breaks below an uptrend line, it suggests a potential downward reversal, indicating a bearish signal.

- Trade Confirmation: Use the EMV indicator to confirm other technical indicators or chart patterns. For example, if a bullish chart pattern like a double bottom formation is observed, waiting for the EMV line to rise above zero can act as a confirmation to enter a long position.

It's important to note that no indicator can guarantee profitable trades on its own. Traders often combine the EMV indicator with other tools and analysis to increase the probability of successful trades. Additionally, it is recommended to practice and analyze the indicator within a demo or backtesting environment before applying it to live trading.

How to use the Ease of Movement (EMV) indicator to plan entry and exit points?

The Ease of Movement (EMV) indicator is a momentum oscillator that measures the relationship between price change and volume, helping traders to identify and confirm the strength of a trend. Here are some steps to use the EMV indicator to plan entry and exit points:

- Understand the EMV indicator: The EMV indicator consists of a line that fluctuates above and below a zero line. Positive EMV values indicate buying pressure, while negative values indicate selling pressure. The size of the EMV values reflects the strength of the trend.

- Analyze the EMV line: Look for divergences or convergences between the EMV line and the price action. If the price is making higher highs while the EMV line is making lower highs, it could be a bearish divergence and may signal a possible trend reversal. Conversely, if the price is making lower lows while the EMV line is making higher lows, it could be a bullish divergence and may indicate a possible trend reversal.

- Identify support and resistance levels: Plot support and resistance levels on the price chart. Pay attention to how the EMV line behaves when it approaches these levels. If the EMV line fails to penetrate a resistance level, it could be an indication of a potential trend reversal or a strong resistance level.

- Define entry points: Use the EMV indicator in conjunction with other technical analysis tools to confirm your entry points. For example, you can look for a bullish EMV crossover above the zero line as a signal to enter a long position. Conversely, a bearish EMV crossover below the zero line may indicate a signal to enter a short position. Confirm these signals with other indicators or chart patterns.

- Determine exit points: The EMV indicator can also help to identify when to exit a position. For example, if you are in a long position and the EMV line starts to decrease and cross below the zero line, it may be a signal to close the position. On the other hand, if you are in a short position and the EMV line starts to rise and cross above the zero line, it may indicate a signal to close the position.

- Combine with other indicators: To increase the probability of accurate entry and exit points, consider using the EMV indicator in combination with other technical indicators, such as moving averages, trendlines, or oscillators.

Remember that no single indicator is foolproof, and it is important to practice good risk management and use proper position sizing when trading based on the EMV indicator or any other technical analysis tool.

What are the different timeframes suitable for analyzing the Ease of Movement (EMV) indicator?

The Ease of Movement (EMV) indicator is commonly used to measure the relationship between volume and price changes in a given security. The choice of timeframe for analyzing the EMV indicator depends on the trader's preference, trading style, and investment goals. Here are some common timeframes suitable for analyzing EMV:

- Intraday: For short-term traders focusing on intraday price movements, using EMV with a timeframe ranging from minutes to hours can provide insights into the ease of buying or selling pressure. This timeframe allows traders to capture short-term trends and make quick trading decisions.

- Daily: Daily timeframe EMV analysis is popular among swing traders and active investors. By analyzing the indicator on a daily basis, traders can gauge the strength of buying or selling pressure over a more extended period. This can help identify potential trends or reversals and determine appropriate entry and exit points for their trades.

- Weekly: Investors with longer-term investment horizons may find weekly EMV analysis beneficial. This timeframe smooths out daily fluctuations and provides a more comprehensive view of the security's ease of movement over a week. Weekly EMV signals can assist in identifying long-term trends and assist in making well-informed investment decisions.

- Monthly: Monthly EMV analysis is suitable for investors who take a highly patient and long-term approach. By analyzing the indicator on a monthly basis, traders can identify significant trends and reversals, which are more likely to impact the security's value over the long run.

It is essential to note that the choice of timeframe ultimately depends on the trader's strategy, goals, and time available for trading. Combining EMV analysis with other technical indicators and conducting multiple timeframe analysis can provide a more well-rounded understanding of a security's price and volume dynamics.

What are the main advantages of using the Ease of Movement (EMV) indicator for day trading?

The Ease of Movement (EMV) indicator is a technical analysis tool that measures the relationship between price and volume, aiming to determine the ease or difficulty with which price is moving. Here are some main advantages of using the EMV indicator for day trading:

- Identifying trend strength: The EMV indicator provides insights into the strength and sustainability of a trend by analyzing the relationship between price and volume. It helps traders determine if the current trend is strong or weak, allowing them to make informed trading decisions.

- Early identification of potential reversals: The EMV indicator can help traders spot potential trend reversals before they become apparent on price charts. By analyzing changes in price and volume, it can give early indications of buying or selling pressure, helping traders to anticipate and capitalize on trend reversals.

- Combining price and volume analysis: The EMV indicator combines price and volume data, providing a comprehensive analysis of market movements. By considering both factors, traders can gain a deeper understanding of market dynamics and make more informed trading decisions.

- Enhancing other trading strategies: The EMV indicator can complement other technical analysis tools and trading strategies. When used in conjunction with other indicators or patterns, it can provide additional confirmation signals and increase the accuracy of trade setups.

- Accessibility and ease of use: The EMV indicator is widely available on most trading platforms and is relatively simple to use. Traders can easily incorporate it into their existing technical analysis toolkit without requiring extensive knowledge or expertise.

It's worth noting that while the EMV indicator offers several advantages, it is essential to use it in conjunction with other tools and conduct thorough market analysis. No indicator can guarantee successful trades, and it is essential to consider multiple factors before executing any trading decisions.