Best SMA Strategies to Buy in November 2025

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.blogweb.me/1/51_Jozc_NDI_6_L_SL_160_dbad2eb36b.jpg)

The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

My Trading Journal - Premium Log Book for Stock Market, Forex, Options, Crypto - Guided Trading Journal with 80 Trades, 8 Review Sections - Ideal for Day Traders, Swing Traders, Position Traders

-

TRACK TRADES PRECISELY: IMPROVE PERFORMANCE WITH DETAILED ANALYSIS.

-

CUSTOMIZABLE SETUP: TAILOR STRATEGIES TO MAXIMIZE TRADING SUCCESS.

-

DURABLE QUALITY: A PREMIUM JOURNAL DESIGNED FOR DAILY TRADING USE.

Options Trading: How to Turn Every Friday into Payday Using Weekly Options! Generate Weekly Income in ALL Markets and Sleep Worry-Free!

Gimly - Trading Chart (Set of 5) Pattern Posters, 350 GSM Candle Chart Poster, Trading Setup Kit for Trader Investor, (Size : 30 x 21 CM, Unframed)

- ENHANCE TRADING SKILLS WITH VIBRANT, EASY-TO-READ CHART PATTERNS!

- DURABLE 350 GSM PAPER ENSURES LONG-LASTING, QUALITY USE!

- PERFECT FOR STOCK AND CRYPTO MARKETS-BOOST YOUR TRADING GAME!

Day Trading Flash Cards - Stock Market Chart & Candlestick Patterns, Instructions to Trade Like a Pro!

-

MASTER TRADING WITH 67 PATTERNS FOR QUICK MARKET SUCCESS!

-

PERFECT FOR ALL LEVELS: BUILD CONFIDENCE AND MAKE WINNING TRADES!

-

DURABLE, PORTABLE FLASHCARDS: YOUR GO-TO TOOL FOR ON-THE-GO LEARNING!

12Pcs Trading Chart Pattern Posters Candlestick Pattern Poster Bulletin Board Crypto and Stock Market Trading Poster Office Decorations for Trader Investor Supplies Wall Door Decor 11 x 15.7 Inches

- COMPLETE SET: 12 POSTERS AND 100 DOTS FOR EFFORTLESS SETUP.

- STYLISH DESIGN: CLEAR PATTERNS ENHANCE ANY TRADING WORKSPACE.

- DURABLE QUALITY: THICK, LAMINATED CARDS ENSURE LASTING READABILITY.

Trading Journal: Guided trading journal, trading log book & investment journal. 300 pages to track psychologic patterns, manage risk and improve trade after trade. Compatible with crypto, stocks and forex market

The Trader's Handbook: Winning habits and routines of successful traders

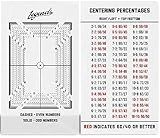

Legends Card Grading Centering Tool by Envy Born Games | Cleaning Cloth Kit Material for PSA - BGS

- ENSURE PSA/BGS COMPLIANCE-SAVE ON GRADING FEES WITH PRECISE CENTERING!

- DURABLE, SCRATCH-RESISTANT DESIGN PROTECTS YOUR INVESTMENT IN TRANSIT.

- EASY-TO-USE TOOL PLUS BONUS CLEANING CLOTH FOR OPTIMAL CARD CARE!

The Simple Moving Average (SMA) is a widely used technical analysis tool in trading. It is a trend-following indicator that helps traders identify the direction of price movement and potential support or resistance levels.

To apply SMA in trading, you need to calculate the average price of a security over a specific period of time. This period can vary depending on your trading strategy and time frame. The most common time periods used are 50, 100, or 200 days, but you can adjust it according to your preference.

To calculate the SMA, you sum up the closing prices of the security over the chosen period and then divide it by the number of periods. The formula is as follows:

SMA = (sum of closing prices over n periods) / n

Once you have the SMA calculated, you plot it on your chart. It creates a smooth line that reflects the average price movement over the selected period. This line can help you identify trends and determine potential entry and exit points.

When using SMA for trading decisions, there are a few key concepts to consider:

- Trend identification: If the price is consistently above the SMA line, it indicates an uptrend. Conversely, if it consistently falls below the SMA, it suggests a downtrend.

- Support and resistance levels: The SMA can act as support or resistance levels where the price may bounce off. Traders look for the price to hold above the SMA in an uptrend or below the SMA in a downtrend.

- Crossovers: When a shorter SMA (e.g., 50-day) crosses above or below a longer SMA (e.g., 200-day), it signals a potential change in trend. This crossover is commonly referred to as the Golden Cross (bullish) or Death Cross (bearish).

- Price relationship to SMA: Traders can observe how the price reacts to the SMA. If the price consistently stays above the SMA, it indicates strength in buyers. On the other hand, if the price consistently stays below the SMA, it suggests weakness in buyers and potential selling pressure.

It's important to remember that the SMA is a lagging indicator, as it is based on past data. Therefore, it may not always accurately predict future price movements. It is often used in combination with other indicators and analysis techniques to develop a comprehensive trading strategy.

What is the significance of SMA convergence and divergence?

SMA (Simple Moving Average) convergence and divergence are important concepts in technical analysis, primarily used in studying trends in financial markets, specifically stock markets.

- Convergence: SMA convergence refers to when two or more moving averages with different time periods are moving closer together. When the shorter-term moving average (e.g., 25-day SMA) crosses above the longer-term moving average (e.g., 50-day SMA), it indicates a potential bullish signal. This convergence implies that the shorter-term trend is strengthening, and it could result in upward price momentum. Traders use this as a trend-following signal to enter long positions.

- Divergence: SMA divergence is the opposite of convergence and occurs when the moving averages move farther apart. When the shorter-term moving average crosses below the longer-term moving average, it signals a potential bearish signal. This divergence implies that the shorter-term trend is weakening, and it could result in downward price momentum. Traders use this as a trend-following signal to enter short positions or exit long positions.

The significance of SMA convergence and divergence lies in their ability to provide a visual representation of trend changes and potential buying or selling opportunities. By observing the relationship between moving averages of different time periods, traders can gain insights into the market sentiment and make more informed trading decisions. However, it is important to note that SMA convergence and divergence are just one tool among many used in technical analysis, and they should be used in conjunction with other indicators and analysis methods to confirm signals and make well-rounded trading decisions.

How to automate trading strategies based on SMA signals?

Automating trading strategies based on Simple Moving Average (SMA) signals can be done using various programming languages and platforms. Here's a general approach to automating such strategies:

- Choose a Trading Platform: Select a trading platform that supports automated trading or offers an API for programmatic trading. Some popular platforms include MetaTrader, TradeStation, NinjaTrader, and Interactive Brokers' API.

- Define SMA Signal Conditions: Determine the conditions for generating buy and sell signals based on SMA crossovers or other criteria. For example, a common strategy is to generate a buy signal when the shorter-term SMA (e.g., 50-day) crosses above the longer-term SMA (e.g., 200-day), and a sell signal when it crosses below.

- Implement the Strategy in a Programming Language: Use a suitable programming language (e.g., Python, C#, Java) to write the code for your trading strategy. This involves accessing historical price data, calculating the SMAs, and generating the buy/sell signals based on the defined conditions.

- Connect to the Trading Platform or API: Establish a connection between your code and the trading platform or API. If the platform provides an API, you'll need to learn how to interface with it using the programming language you've chosen.

- Execute Trades: Once the buy or sell signals are generated, use the trading platform's API or built-in functionality to execute the corresponding trades automatically. Ensure you have appropriate risk management measures in place, such as stop-loss orders and position sizing calculations.

- Backtesting and Optimization: Before deploying your automated SMA strategy live, backtest it using historical data to evaluate its performance. Adjust parameters or explore different SMA combinations to optimize your strategy's profitability and risk-adjusted returns.

- Monitor and Adjust: Once the strategy is live, regularly monitor its performance and make adjustments as necessary to adapt to changing market conditions. Keep an eye on the SMA signals, and refine or update the strategy if required.

It's important to note that automated trading carries risks, and careful consideration should be given to system design, risk management, and testing before deploying real capital.

What is the role of SMA in identifying support and resistance levels?

The Simple Moving Average (SMA) is a commonly used technical indicator in analyzing market trends and identifying support and resistance levels. Here are the roles of SMA in this context:

- Trend identification: SMA helps in determining the prevailing trend in a stock or market. By calculating the average price over a specified period, it smoothens out price fluctuations and provides a more accurate representation of the overall trend. Traders often use longer-term SMA values (such as 50-day or 200-day) to identify long-term trends.

- Support levels: SMA can act as a support level when the price approaches or bounces off it during a downtrend. Market participants may perceive the moving average as a price level of interest where buying pressure often arises, resulting in a support zone.

- Resistance levels: Conversely, SMA can act as a resistance level when the price approaches or pulls back from it during an uptrend. Traders might view the moving average as a level where selling pressure tends to emerge, creating a resistance zone.

- Confirmation of support and resistance levels: SMA can validate the significance of support and resistance levels identified by other technical tools or methods. When the price is hovering around a specific support or resistance area and aligns with the SMA, it adds more credibility to that level.

- Moving average crossovers: SMA crossovers occur when two different SMA values intersect. Traders often track the crossover points, such as the 50-day SMA crossing above or below the 200-day SMA, to signal potential shifts in the trend. These points can also act as significant support or resistance levels.

Overall, SMA aids traders and analysts in identifying support and resistance levels by providing a visual representation of the average price over a given period and recognizing areas where price tends to react.

What is the relationship between SMA and price volatility?

The relationship between the Simple Moving Average (SMA) and price volatility can be considered inverse. SMA is a technical analysis tool that helps to smooth out price data over a specified period. It calculates the average price of a security over a specific time frame, typically by adding the closing prices and dividing by the number of periods.

When the SMA is applied to a shorter time frame, such as a 20-day SMA, it tends to react more quickly to price movements. In this case, the SMA will be more sensitive to short-term price fluctuations and can show more volatility.

On the other hand, when the SMA is applied to a longer time frame, like a 200-day SMA, it smooths out short-term price movements and provides a more general trend of the security's price. The longer the time frame, the less volatile the SMA becomes.

Therefore, the shorter the period of the SMA, the more it reflects price volatility, while the longer the period, the less it reflects volatility and provides a more stable trend.

What is a golden cross and how is it related to SMA?

A golden cross is a technical analysis chart pattern that is used in trading to signify a potentially bullish signal. It occurs when a short-term moving average (SMA), typically the 50-day SMA, crosses above a long-term moving average, usually the 200-day SMA.

The golden cross indicates that the price of an asset is experiencing a bullish momentum shift, as the shorter-term moving average indicates that the recent price movement is consistently higher than the longer-term moving average.

Traders use the golden cross as a signal to enter a long position or hold onto existing long positions, as it suggests a significant upward trend in the price of the asset. It is considered a reliable buy signal and is often used in conjunction with other technical indicators to confirm the bullish sentiment.

What is the significance of Simple Moving Average (SMA) in technical analysis?

Simple Moving Average (SMA) is a widely used technical analysis tool that helps traders and investors understand and interpret the overall trend of a security or market. Here are some key significances of SMA:

- Trend Identification: SMA helps in identifying the direction of the trend. By plotting the average price over a specified period, it smooths out short-term price fluctuations, making it easier to identify whether the overall trend is bullish (upward), bearish (downward), or ranging (sideways).

- Support and Resistance Levels: SMA can act as support or resistance levels for the price. Traders often observe when the price crosses above or below the SMA, as these points can indicate potential reversals or continuation of the trend.

- Entry and Exit Points: SMA is used to determine entry and exit points in trading strategies. For example, when the price crosses above the SMA from below, it may be considered a buy signal, while a price crossing below the SMA from above may be seen as a sell signal.

- Confirmation of Trend Reversal: SMA can help confirm a trend reversal. If the short-term SMA crosses above or below a longer-term SMA, it is considered a bullish or bearish signal, respectively, indicating a potential change in trend direction.

- Visualizing Market Strength: SMA can provide insights into the market's strength by observing the angle and distance between different SMAs. Steeper angles and increasing distances between SMAs tend to indicate stronger trends.

- Time Frame Analysis: SMA can be used on different time frames, enabling traders to analyze short-term or long-term trends. Combining different SMAs with varying time periods can provide a more comprehensive picture of the market.

- Smoothed Price Data: Since SMA is based on average prices over a period, it helps in eliminating noise and volatility, making it easier to analyze the underlying trend.

Overall, SMA is a simple yet effective tool in technical analysis that helps traders and investors understand the trend direction, generate trading signals, and make informed decisions.